At the 2021 PPA Annual Meeting, we conducted an extensive survey of members to assess a range of critical elements about their practices. One such item was to find out who had a succession plan in place.

There’s a reason HBO has an excellent (i.e. 9 Emmys and counting) series called Succession: The trials and tribulations of crafting and executing a succession strategy are dramatic to say the least.

Succession plans are important for any business, but succession planning in healthcare is especially important. It’s not the sort of business you can easily shut down and casually walk away from. You’re caring for patients who will expect and deserve continuity of care long after you decide to retire.

Our survey showed that the overwhelming majority of PPA members did not have a succession plan in place, or at least not one that gave them comfort or confidence.

What’s more surprising is that, on average, the respondents had been running their practices for 12 years. These practices weren’t newcomers to the industry.

Succession planning in healthcare is a serious issue that deserves time and attention, and it takes longer than most people think. So whether you’ve been around for a while or are just starting out, it’s never too early to consider what your succession plan might look like and start developing a strategy to put it in place.

Why Succession Planning in Healthcare Is Serious Business

Very few businesses operate for 20 years, close up shop, and toss the keys to the landlord. Whether it’s an attorney’s office or a plumber, a restaurant or an electrician, a business is an asset the owner spent years building — and they plan to sell it, or arrange for it to endure.

We haven’t quite reached this mindset yet throughout private medical practices. Some physicians still picture themselves just shutting the doors when they retire. But what about all those patients? Do they simply have to return to a conventional office?

And what about your practice? The business you’ve spent years building has become an asset. What if it could continue to provide quality care for your community — and income to you — in other capable hands?

We need a shift in our thinking to start seeing succession planning as an aspect of quality of care. It means ensuring patients never have to go back to the old hamster-wheel model they left. Instead, they’ll have continuity of care without even having to look for a new practice.

What you’ve built isn’t easy. In fact, it’s nearly impossible for most people. But you’ve plowed the path of a new business in a relatively new model of medical practice — and you’ve done it well.

Few people have that level of risk tolerance, assertiveness, guts, and savvy. Newly graduating physicians may make great doctors, but it will always be a small number who start something from scratch. However, they may be fantastic at coming into an established practice, keeping it running, and producing consistent revenue for the retired founder. If you’re able to tap into this, you’ve provided an incredibly valuable stepping stone for other physicians to get into private medical practice.

That’s a ton of value that deserves serious contemplation — and remuneration.

Fortunately, there’s a market for a successful operation like yours, and shrewd suitors will line up to buy in. But if you haven’t thought about what your succession strategy is, you leave yourself vulnerable to being taken advantage of by people who are professionals at buying businesses like yours. So let’s get to work!

How Long It Takes to Plan an Exit

Most physicians I talk to operate on a three- to five-year outlook. They hit the tripwire of, “I think I’ve got another three years or so of practice in me,” and then start thinking about the need for a succession plan.

The reality is that three to five years is not nearly enough time to develop a good succession strategy. It doesn’t leave enough time to account for all the what ifs. You might be able to do it in five years if everything goes perfectly. But 10 years (at least) is a much more comfortable timeframe.

If you’re wondering why, consider what succession planning really entails.

Depending on your plan, you might decide to bring on a new physician to carry your panel. Hiring a new physician isn’t easy to do, but let’s say you find the right one quickly, maybe in six months. Now it takes another year or two for them to demonstrate their competence and prove that they can be your successor. On their side, they also need time to see if running this practice is what they want to do in the long term.

Assuming all goes well, let’s say you invite them to stay on to be your successor. But when they find out how much it’s going to cost for them to buy you out of the practice, they decide to walk away and start their own (after they sit out their non-compete clause), with everything you’ve taught them about finding patients and running a practice.

You’re now two to three years into your five-year plan and back at square one.

Or maybe you find the perfect successor by the end of five years, and they commit to taking over. Step one, find successor — check. Now it’s time for step two — plan and implement your segue out of the business, carefully transitioning your panel and offloading your extensive list of responsibilities in managing the practice. You undoubtedly underestimate all the things you do to keep the practice afloat. How many new hires will need to be made to truly fill your void? Rest assured, it’s not a quick process and could take an additional three to five years.

This is how retiring at 65 unfortunately turns into retiring at 70. Before long, the idea of selling your practice for what it’s worth fades. So you ultimately undervalue what you’ve built because you just want to get out.

When you start to unpack the caliber of human being(s) you need to bring in, the trust that needs to be built, and all the agreements that need to be in place, it’s hard to see any succession plan taking as little as five years.

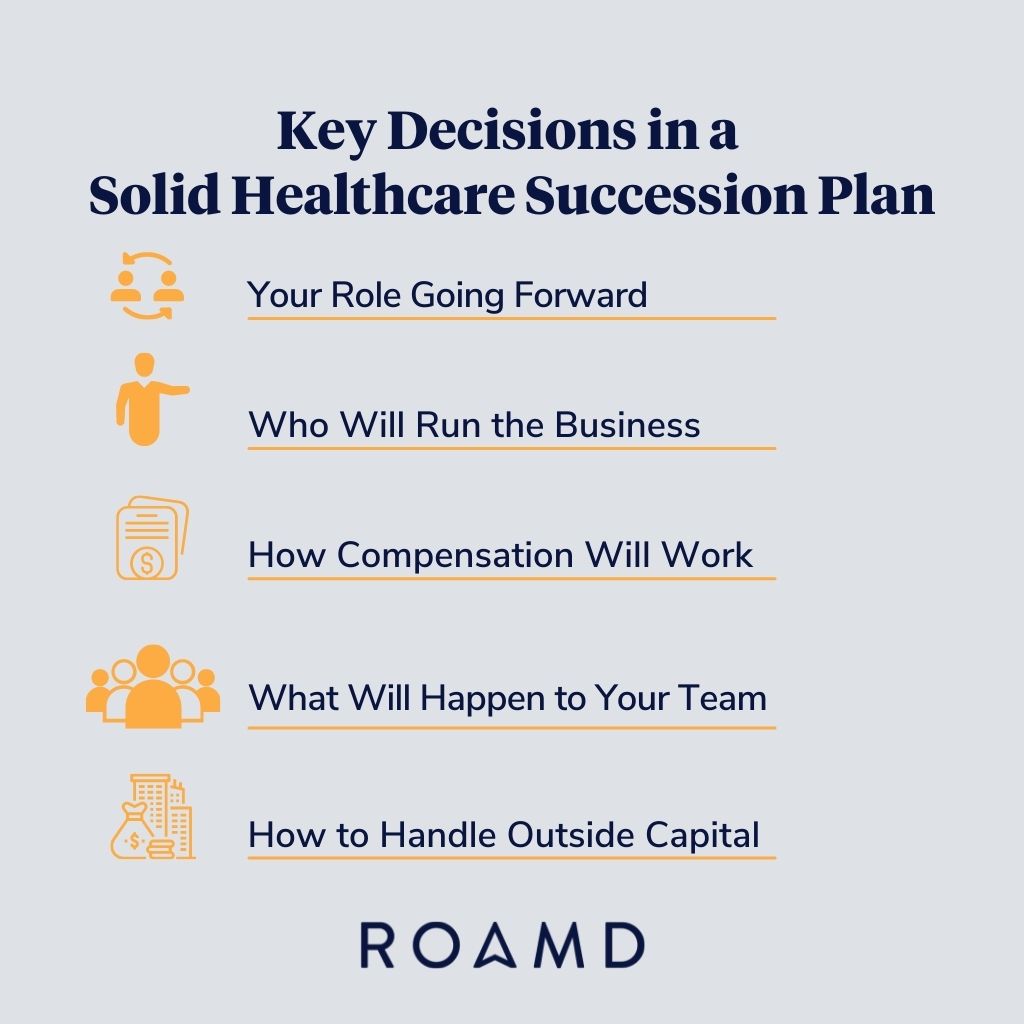

Key Components of a Solid Healthcare Succession Plan

With enough time and a well-designed plan, your succession can go smoothly and provide the return on your investment you deserve. Below are some of the key components to consider.

Determine Your Role Going Forward

The first thing to determine is what your role will be. Will you sell outright or will you continue with the practice in some capacity? Are you going to stay on as an adviser? As a shareholder?

Are you selling 90% of the business and retaining 10%? Do you plan to continue practicing medicine with a “smaller” patient panel? There are a lot of nuances and implications to unpack for yourself before you can answer other questions related to succession.

Determine Who Will Run the Business

The next thing to determine is who is going to run the business. Are you finding a physician to succeed you who’s capable of running both the business and the patient care? This is a true purple unicorn fighter pilot, and they’re rare.

Or, are you finding a physician who wants to focus only on the medical practice side while someone else runs the business? Now you’re not just looking for one person, but two — which might actually be easier.

Decide what you’re looking for up front to lend clarity to your search.

Determine How Compensation Will Work

Yours. As the founder of the business, you have a lot of valid options to choose from in approaches to compensation. Do you plan to take royalties or perpetual distributions? Will there be a buyout period where you continue as a shareholder for a period of time? Or will you only be paid if you see patients?

There’s not a single right or wrong answer on how to arrange your compensation. The only absolute is that if you don’t consider it ahead of time, you will get taken.

Theirs. How will your successor(s) be compensated? Are they bringing their own panels on day one? Or are they taking care of your waitlist? When do they earn equity in the business? Is there a buy-in? A revenue split? How will all of that work?

Have you thought about how to value your equity and when and how much to give away? Far too often, I see practices undervaluing equity as a lever. They give too much away too soon, and they undervalue what the practice is actually worth.

Determine What Will Happen to Your Team

Does the team that’s been with you for the last 12 years get guaranteed employment agreements? Do they get equity buyouts? Do non-competes have to come into place — for the new owner’s peace of mind — to ensure those folks don’t leave when you do? Is there a possibility they’ll lose their jobs the day you walk out the door?

Determine How to Handle Outside Capital

Let’s say you co-founded your practice in a 50/50 split with someone else. And let’s say your partner decides to cash out in three years, but you decide to practice for 10 more years. Are you in a position to buy out their shares? Do you even want to? If not, you have to find someone to buy them out.

When you find a new partner, what is their source of capital? What degree of control are they going to retain over the practice? How might the source of their capital begin to influence that new doctor in matters such as office culture or the direction of the business?

Finding suitors won’t be hard. Suitors know the value of a successful business like yours. But finding the right kind of suitors with the sort of capital you’re comfortable with, and who have interests that align with your vision, can be a monumental challenge.

Conclusion: Start Planning Now

These questions don’t have easy answers, which is why you need so much time to think about and plan for them.

This isn’t even a complete list or guide to succession planning in healthcare. It’s just meant to illuminate how complex of a process it is and how time-consuming it can be.

Ultimately, you will need to answer these questions, and many more, based on your unique plans, goals, and situations. Don’t delay!